Datasonic Group Berhad

(Company No. 809759-X)

15

Chairman’s Statement

(Continued)

In line with the lower revenue, Datasonic’s current profit after taxation (“PAT”) of RM62.892 million for FY16

also compared less favorably than the PAT of RM71.822 million reported in FY15. However, on a pro-rated

basis, the Group’s PAT was 9% higher than the previous financial year.

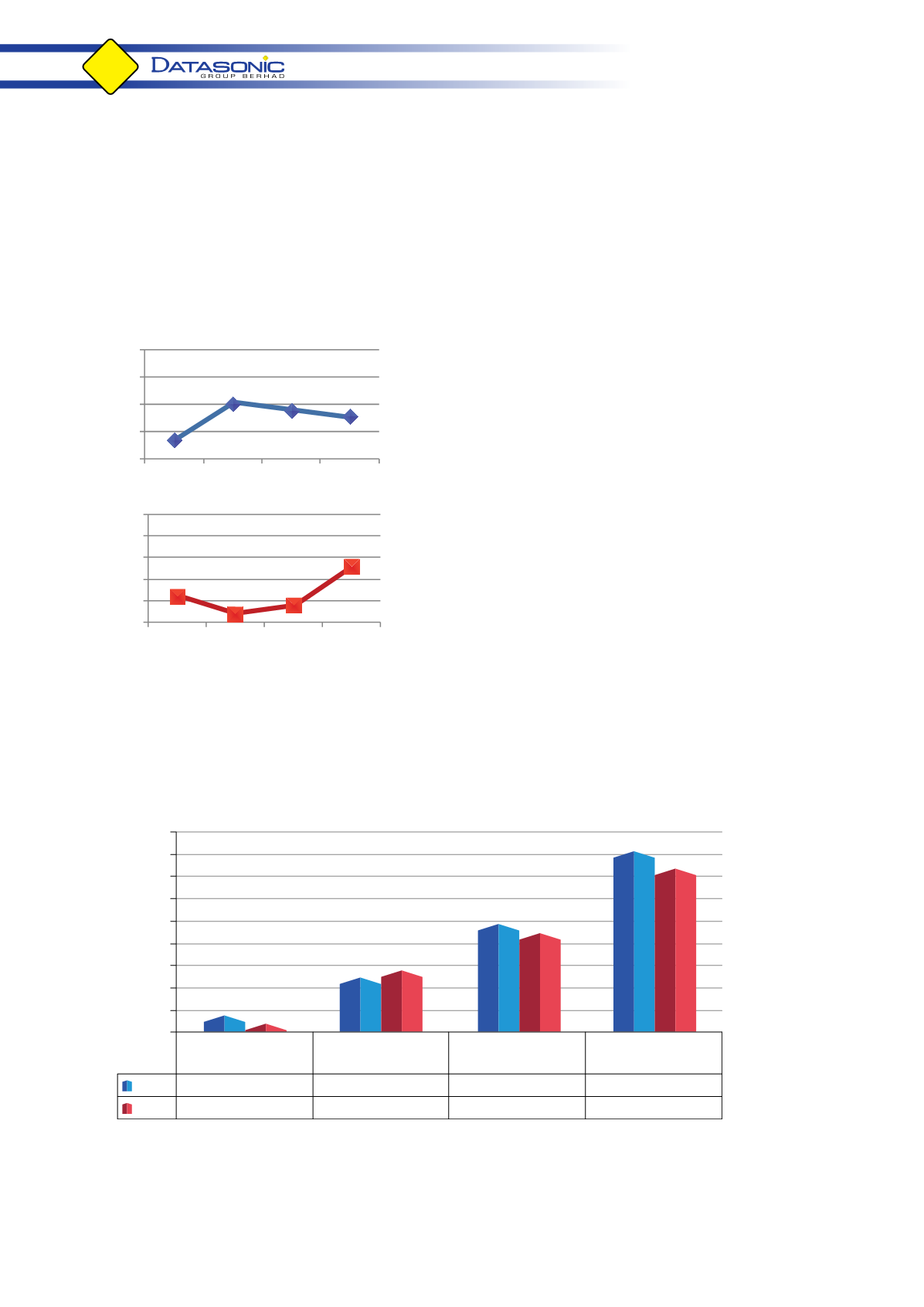

EPS and P/E Ratio

Year-on-year, Datasonic’s basic earnings per share (“EPS”)

has declined marginally from 5.33 sen in FY15 to 4.67 sen in

FY16 (or -12%) mainly due to the lower earnings reported in

the current year as a result of comparing 12 months for FY16

against 15 months for FY15.

Nevertheless, Datasonic’s Price to Earnings (“P/E”) Ratio has

shown an increase of 65% over the past 3 financial years

(from 17x in FY13 to 28x in FY16). Based on the market value

of RM1.30 per share as at 31 March 2016, our P/E ratio at 28

times indicates positive future performance.

Assets

Based on 1.35 billion shares of 10 sen each, Datasonic’s net

assets per share has increased by 1.67 sen (+10%) from 16.51

sen in FY15 to 18.18 sen in FY16.

Assets have increasedmainly due to increase in development

expenditures incurred from September 2015 to March 2016 for the development of the operating system

for the passport chips, in anticipation of the newly awarded contract for the supply of Malaysian passport

chips commencing 1 December 2016.

In addition, total trade receivables have also increased in the current year due to more deliveries towards

the end of the financial year.

Equity and Liabilities

Year-on-year, total Equity rose from RM222.859 million as at 31 March 2015 to RM245.250 million as at 31

March 2016 mainly due to increase in retained earnings less three (3) interim single-tier tax exempt dividends

amounting to RM40.5 million which were declared during the financial year.

Other Liabilities

Borrowings

Equity

Total Equity &

Liabilities

FY16

34.717

FY15

8.727

0

50

100

150

200

250

300

350

400

450

RM'million

EQUITY AND LIABILITIES

405.061

245.250

125.094

365.945

222.859

134.359

2.08

6.07 5.33 4.67

0

3

6

9

12

FY12 FY13 FY15 FY16

FY12 FY13 FY15 FY16

EPS (sen)

21

17

19

28

15

20

25

30

35

40

P/E Ratio (times)